- Introduction to Meta Platforms (formerly known as Facebook)

- Overview of Meta's financial performance and stock history

- The impact of social media on our daily lives and its potential for growth

- Diversified revenue streams and expanding business ventures of Meta

- The importance of responsible investing and ethical considerations with Meta stock

- Expert opinions and market projections for Meta stock in the future

- Conclusion: Is investing in Meta Platforms a smart move?

- FAQs:

Introduction to Meta Platforms (formerly known as Facebook)

Fintechzoom Facebook Stock: For the tech giant formerly known as Facebook, Meta Platforms, the storm has not diminished either on Wall Street or elsewhere. With unique business ideas concerning social networking and with growing expansion into virtual reality, investing in Meta stocks may be a wise business strategy. Since the world is becoming largely digital, it is important for every investor who wishes to be on top to comprehend how this powerhouse operates. In case one wants to find out more about the Company’sCompany’sCompany’sCompany’s business or the prospects for its related social network, exploring fintechzoom Facebook stock will help with understanding the rationale behind the need to buy stocks of Meta Platforms.

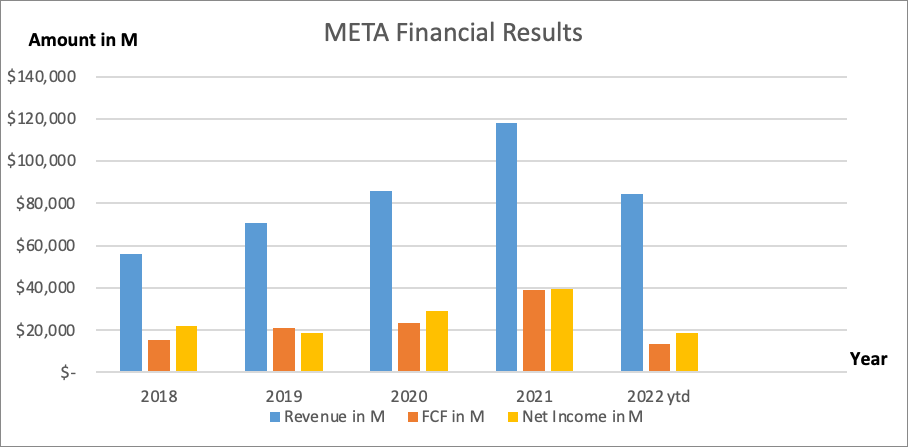

Overview of Meta’s financial performance and stock history

In terms of performance, Meta Platforms has gone through thick and thin since its initial public offering. The stock price trends were high, meaning that the market was highly optimistic about the prospects of social media. However, there were issues with privacy and regulation, which made the investors worried, and confidence was lacking. In recent years, it has been quite stable due to the shift in operations by the Meta Company, where it started engaging in augmented reality and virtual worlds. This change is aligned with their grand plan of reeling into the metaverse.

Advanced advertising has been a consistent source of income for the CompanyCompanyCompanyCompany, going against many challenges. Company reports show the number of people using all or some American apps, such as Instagram and WhatsApp, remains high. Moreover, such a company is willing to invest enormous resources in advanced technologies, again highlighting its position regarding prospects. Regarding stock history, there was an adaptation in story and strategy through transitioning to a changing market – presenting risks and rewards for investors looking at fintech Zoom Facebook stock prospects in the short term.

The impact of social media on our daily lives and its potential for growth

Today’s generation of social networks is not only a commutation tool where the only opinion that matters is that of the users and the management, nor is advertisement the main focus. The case where Meta is now employed in the interaction between people and business is encouraging. Having encouraging feedback from the audience and inviting people to statistics encourages growth. Some organizations have, however, resolved to use social networks to promote more innovative ways of reaching out and marketing their products.

Most importantly, user-generated content enables marketers to participate actively in the promotion process. It also guarantees an increase in revenue generation and helps the organization build up the bin commitment to the customers. The same way that technology improves is the way that social networks change. Some improvements, like increasing reality and virtual reality, will be useful in increasing users’ satisfaction in the coming years. And where the furthering of the pace-oriented companies is concerned, companies who go into these trends will likely gain soon.

Diversified revenue streams and expanding business ventures of Meta

Meta Platforms are no longer just social media. It has developed the CompanyCompanyCompanyCompany into a conglomerate with so many arms that it grows despite the primary area. Advertising remains an important component. However, Meta has also entered such domains as virtual and cuticle reality via Oculus. This diversification leverages the increasing preferences for 3D content among consumers. Moreover, expanding on metaverse development provides additional opportunities and means for revenue generation. Users could soon find themselves in extensive virtual environments where trade is part of the experience.

Furthermore, Meta’s new developments in e-commerce present great opportunities for businesses that need to reach out to the audience online. Functionalities such as Shops enable brands to trade and are built straight into the apps. These activities and business strategies confirm that Meta is not just another social media corporation but is gradually becoming necessary for everyone and active in almost every field of the economy.

The importance of responsible investing and ethical considerations with Meta stock

The investment world was able to live through a period of irresponsible or reckless investing, but moving forward with a company like Meta Platforms, responsible investing has been accentuated. Should investors go wrong, there is no going back – ethical questions arise at the forefront. Meta, including Facebook, has had much more than its fair share of being accused of privacy violations and abuse of its platforms for distributing misinformation.

Someone going through these challenges will have a good idea of what drives fintechzoom Facebook stock.… ESI is not only about earnings; it also means attention to what is being invested and why. Long-term performance-wise, it is perhaps less flashy. Still, companies that habitually invest in their transparency and undertake socially responsible investments will be beneficial for ethical and corporate reasons in the long run.

While doing so, you study indicators to earn higher dividends and assess the adequacy of the Company’sCompany’sCompany’sCompany’s management of controversies. Deciding where to put your money or talking about money has been seen as a vote supporting responsible capitalism. This reconciliation cannot be easily accomplished, which means that profiting and ethics will be the bullseye of investment from now on.

Expert opinions and market projections for Meta stock in the future

Wariness is the mood of analysts as they look into Meta platforms with some degree of optimism. Some analysts predict stable performance due to the firm’s recent expansion of its activities in the virtual and augmented reality domains. Recently, a report stated that as they evolve their metaverse vision, new monetization opportunities will be in the picture for Meta.

As the digital world progresses, these new elements help them compete better. Still, analysts highlight that not every opinion is negative. Fears about the potential impacts of government business model scrutiny and privacy issues permeate it all. These experts note that these issues will also affect future earnings. However, several investment companies were reported in the recent changes in the investment prospects of the Meta company stock, referring to the presence of a strong business and the growth of the user audience.

This report suggests that the consensus looks cautiously optimistic for investors wishing to consider the stock opportunities of fintechzoom Facebook. According to the expert’s reports, this indicates that potential benefits and risks await Meta’s investors.

Conclusion: Is investing in Meta Platforms a smart move?

Meta Platforms, the Facebook owner, has more room to grow in the eyes of many investors. It is of great interest how the business has developed from time to time and now comprises a multi-dimensional corporation. Further, it holds some measure of sustained relevancy in the market, having enjoyed such robust financials and impressive market history, including periods when the stocks’ market was down.

No, Sosluka must be cruel to the writers who deny the merits of social networking sites. Despite the Company’sCompany’sCompany’sCompany’s growth, the expansion of Southeast Asian markets translates, in fairness, into the China demand manufacturing capacity they offer to the Inc. However, introducing globalization for many economies of such nature will create market opportunities for companies like Meta and numerous competitive advantages. Still, the core values of socially responsible investment should be preserved. While analyzing Meta Platforms and other stocks in the technology sector, one must always integrate moral thinking, particularly regarding data utilization and its effect on society.

This is important because it requires an individual to be responsible enough and maximize the investors and more liabilities that may call for regulation. Most analysts believe there is further scope for the expansion of Meta stock, even if the CompanyCompanyCompanyCompany leaves behind the current worries and takes advantage of the available long-term opportunities in virgin markets. The most recent estimates of market sales sales and the so-called historic glass overflow hinds are rising. When it comes to whether or not to invest in fintechzoom Facebook stock, there are always obstacles, such as the need for risk/reward assessment.

FAQs:

What is fintechzoom Facebook stock?

Fintechzoom Facebook stock refers to the insights and analysis provided by FintechZoom on Meta Platforms’ stock performance.

Why should I consider investing in fintechzoom Facebook stock?

Investing in fintechzoom Facebook stock could be smart due to Meta Platforms’ expansion into virtual reality and consistent revenue growth.

How has fintechzoom Facebook stock performed historically?

Fintechzoom Facebook stock has seen highs and lows, reflecting market optimism and challenges, but due to strategic shifts, it remains a stable investment.

What impact does social media have on fintechzoom Facebook stock?

Social media’s impact on fintech Zoom Facebook stock is significant as Meta Platforms continues to innovate and expand its user base.